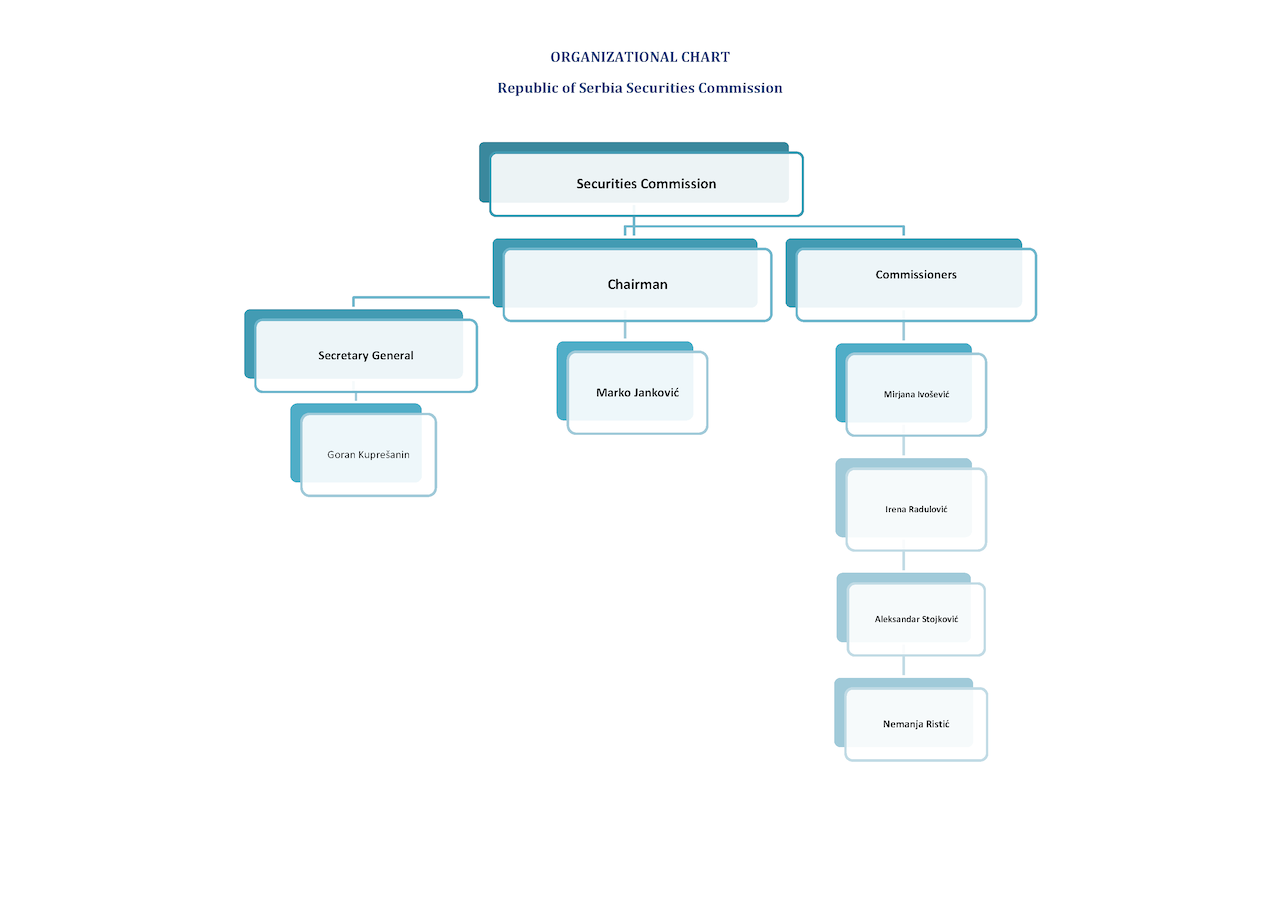

The Securities Commission is comprised of the Chairman and three Commissioners.

The Chairman and the Commissioners are persons appointed by the National Assembly of the Republic of Serbia.

The Secretary General is appointed by the Chairman and the Commission. They are all full time employees of the Securities Commission. The current X term of office (sitting) took their duties on 24 November 2021.

The Securities Commission is comprised of Chairman Marko Janković and Commissioners: Mirjana Ivošević, Aleksandar Stojković, Irena Radulović and Nemanja Ristić.

The Chairman and the Commissioners are persons appointed by the National Assembly of the Republic of Serbia.

The Secretary General is appointed by the Chairman and the Commission. They are all full time employees of the Securities Commission. The current X term of office (sitting) took their duties on 24 November 2021.

The Securities Commission is comprised of Chairman Marko Janković and Commissioners: Mirjana Ivošević, Aleksandar Stojković, Irena Radulović and Nemanja Ristić.

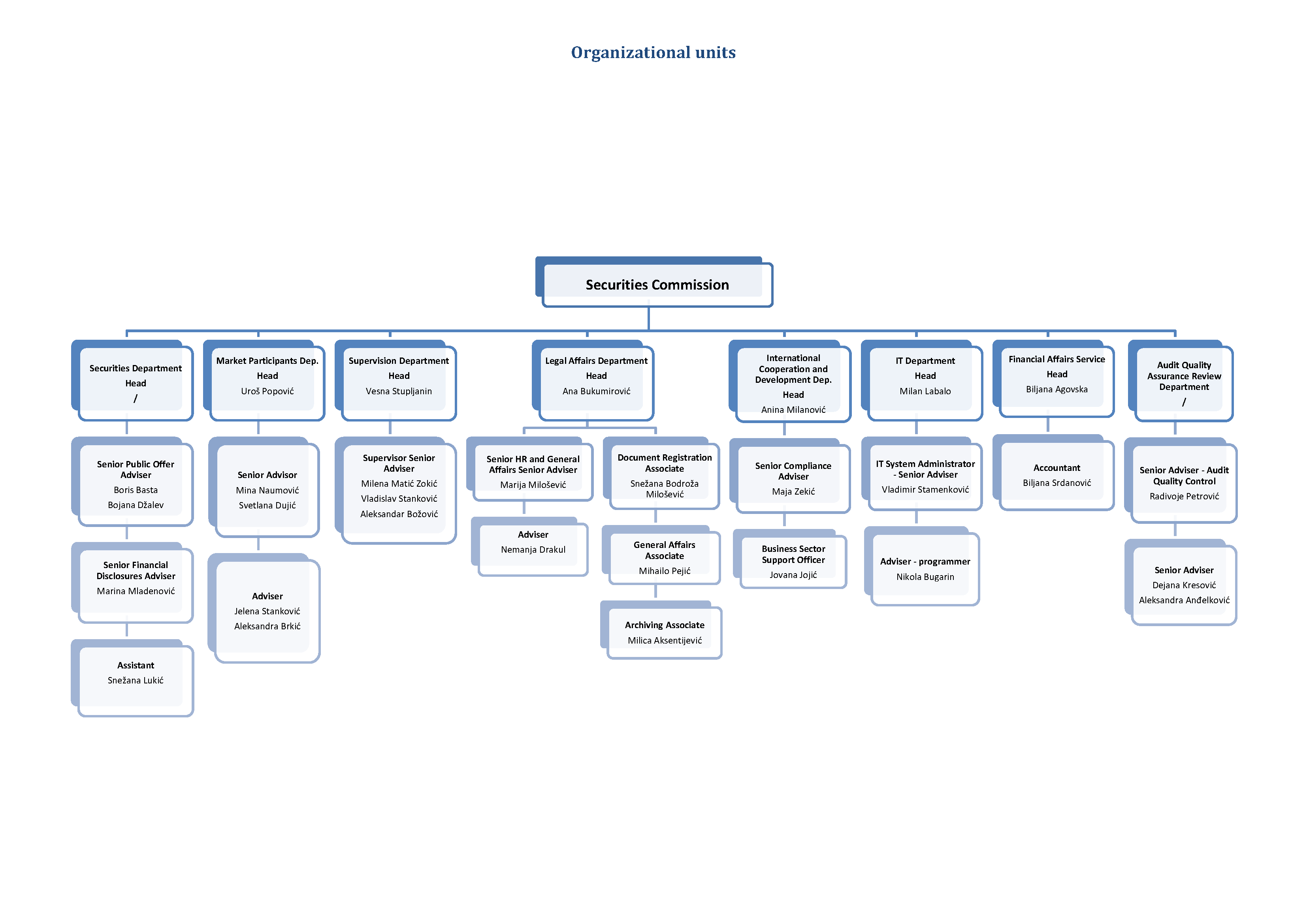

Internal organization of the Securities Commission:

1.Department for Securities and Public Company Register

2.Market Participants Department

3.Supervision Department

4.Legal Affairs Department

5.IT Department

6.International Cooperation and Development Department

7.Financial Affairs Service

8. Quality Assurance Review Department

|

|